Posts

It is important to note that a keen Acorns Early account could only become reached from the students between your age of 18 and twenty-five (age may vary by county). Silver professionals secure a-1% fits on the all the benefits to an enthusiastic Acrorns Early account. Let’s unpack exactly how Acorns Purchase work, in addition to membership level profile and you can collection choices. Inside the 2024, kids’ financial health system GoHenry matched having Acorns.

Commitment Apps

Acorns will make added bonus matches investments up to 50% of one’s benefits. You will get access to educational programs, financial for kids, and a great $ten,100000 life insurance policy. Acorns is among the finest financing apps for starters and you can hand-from investors who wish to start using but they are overrun by the the options along with other spending software. This simple and easy-to-play with system also provides a decreased financing minimum, profile diversification, and you can pupil-friendly charting systems. Acorns is far more expensive than other no-fee apps available to choose from, nevertheless the simpleness may make they practical for certain users. None Atomic Purchase nor Nuclear Brokerage, nor some of their affiliates is actually a financial.

The fresh payment invested to your investment differs from 1% for traders just who pick the Traditional collection allotment in order to 5% to possess Aggressive financing profiles. Acorns offers use of that it resource classification through a good Bitcoin-connected ETF. Clients are allowed to spend some as much as 5% of its profile’s holdings to that particular specific economic resource by this car rather than taking on significant purchase otherwise government costs. Cryptocurrencies have more and more getting a widely acknowledged financial asset that give particular upside to conventional profiles because of the and in case a higher risk you to definitely may cause high efficiency.

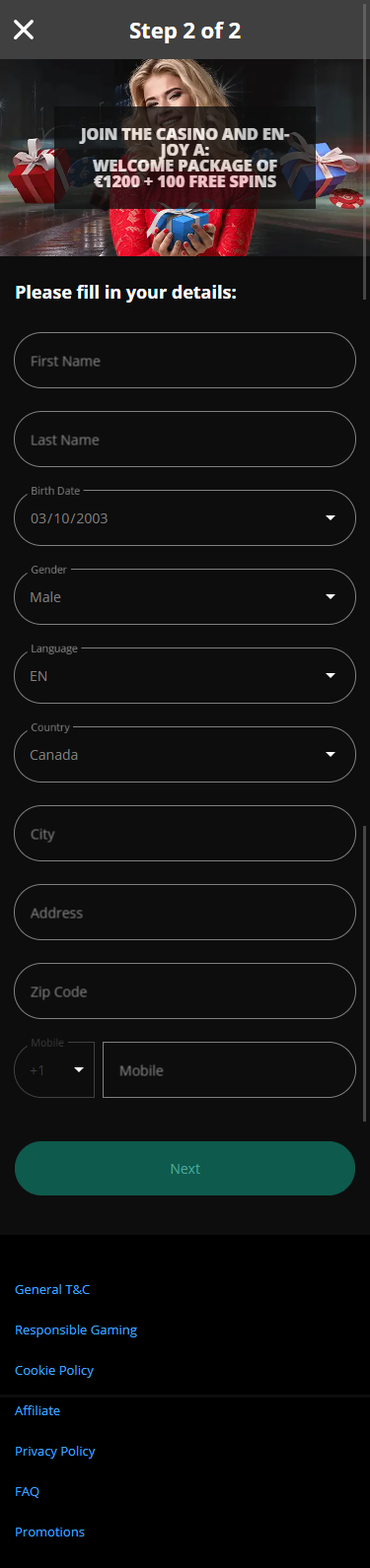

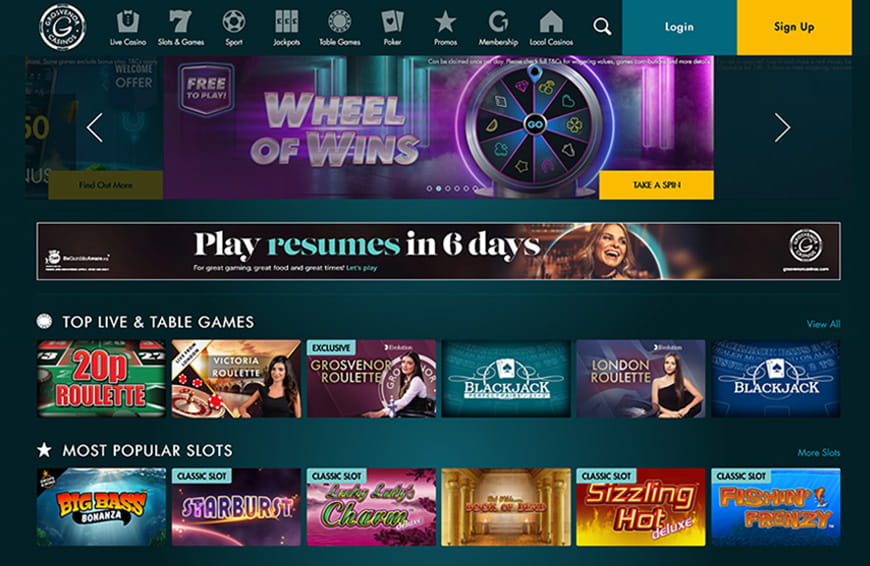

No deposit incentives enable it to be people to begin with to play rather than initial investment their accounts, making these types of incentives very glamorous. DraftKings Gambling establishment’s https://happy-gambler.com/phoenix-sun/rtp/ directory of gaming options and lowest put standards enable it to be a famous possibilities certainly professionals. Loss Financial, were only available in 1998, is an online bank and its particular identity represents Transport Alliance Bank.

Added bonus code: LCB20

To start with, you’ll rating $20 totally free once you manage an alternative membership, which is an impressive offer for those who’re not used to 888 Gambling enterprise or gambling on line entirely. I direct you at all times, taking you away from citizenship or abode by investment application. Finalize disregard the by purchasing a house, transferring finance, otherwise doing almost every other economic obligations. Also, the brand new Italy Golden Visa offers owners charge totally free access to the fresh Schengen zone whenever travelin. The newest Cyprus long lasting residence system lets people to provide instantaneous family members players in their applications.

In which Acorns drops brief

Nonetheless, you can prefer alternatively to sell the opportunities and you may transfer finances to help you a bank checking account. There is no charges for this, but you might want to take care not to protected financing loss (or lead to money progress fees) unintentionally. The good news is that in the event that you spend money on the brand new Gold otherwise Gold arrangements, you can even already been alongside wiping aside you to definitely membership percentage completely. Acorns also offers whatever they name Later Match, an enthusiastic IRA share matches of 1% to own Silver professionals otherwise step three% for Silver professionals.

One-Day Playthrough

While the field fluctuates as well as the values of your bonds changes, Acorns are working to help you rebalance your collection to help you the appointed level away from risk. Which rebalancing assurances the right advantage allocations inside your account, thus you are very likely to visit your currency grow. Spare transform invested having Round-Ups is transported from your own linked investment origin (savings account) to your Acorns Invest membership when triggered. Round-Up investment away from an external membership would be canned should your Pending Round-Ups arrived at or go beyond $5. In general, i very recommend Acorns to those that the brand new to help you spending their funds, specifically those committed to mode more money away money for hard times.

Obviously, individual money is actually personal very one individual’s sense may vary away from other people’s, and estimates according to earlier results do not make certain coming efficiency. Therefore, our very own advice might not use right to your own personal condition. We are really not economic advisors and now we strongly recommend you talk to an economic professional before making people significant economic conclusion. A different one your best funding software providing a comparable service during the a similar price are Hide. Acorns from time to time rebalances your portfolio to make sure your favorite asset allotment stays to your address.

For lots more information about Nuclear Brokerage, delight understand the Mode CRS, the brand new Nuclear Brokerage Standard Disclosures, as well as the Privacy policy. Charges such regulatory charge, exchange costs, financing expenditures, broker earnings and you can features fees get connect with the broker membership. The collection allotment, otherwise exactly how much of one’s portfolio is during brings as opposed to ties and other assets, hinges on issues just like your many years and you will using timeline.

All of the eight basic symbols of your own video game perform they with outlined drawing-out away from better-identified forest dwellers. As previously mentioned just before, the fresh cues reside in the whole room for the reels and you may so can be stacked, which means that they appear from the straight set of five to the for each and every reel. The brand new tunes records is simply, at the same time, alternatively fake and you may consists of an upbeat song to help you gamble whenever the fresh reels try rotating.

Fantastic Bank are FDIC insured.As much as $250,100 is safe within the a single family savings. Regarding the Google Play shop, the brand new Golden 1 cellular software provides 4.6 of 5 celebs. Armed forces provider participants just who generally reside in Ca also are eligible if they are already out of county. To be a part, you will need to unlock a protecting account that have at least $step 1.

Sure, family such as partners, students and you may dependent mothers, will be used in of several Golden Charge apps. Some aspects of Golden Charge getting rejected includes not having the brand new adequate financing, a criminal history, failure so you can conform to courtroom requirements and incomplete or incorrect records. Sure, you might however sign up for a fantastic Visa even although you’ve been denied a charge in the past. Yet not, prior charge denials could be thought inside application techniques, and you may need provide more documents to handle one inquiries. Immediately after accepted, you’ll discovered your Golden Charge, giving your temporary or long lasting residency legal rights.

Should i renew my Golden Charge indefinitely?

This will ensure it is Acorns to expend free go from all of the purchase that have Acorns Round-Ups and supply extra assets while shopping which have Acorns’ Discover Money lovers. Choices exchange involves significant chance which can be perhaps not appropriate for all investors. Alternative buyers can be rapidly lose the value of its financing inside the a short span of energy and happen permanent losses by the expiration date. You ought to done an ideas exchange app and have recognition for the qualified membership. Delight check out the Services and you will Risks of Standard Alternatives before change alternatives.